All Categories

Featured

Table of Contents

The good news is, that's starting to alter. With new technology comes brand-new chance, and there are currently a number of applications and systems that allow non-accredited financiers to obtain in on the action.

With Concreit, you can relax very easy understanding that your cash is diversified throughout hundreds of high-yielding income-focused first-lien mortgages in the United States. This cash circulation technique has actually been used by bush funds and exclusive equity funds for affluent investors. Expand your profile out of riskier and extra unpredictable investments like crypto and specific stocksConcreit spends in hundreds of high-yielding income-focused first-lien home loans across the United States, which helps to decrease riskDividends with Concreit are paid weekly, and the ordinary annualized return has been 5.5% over the last yearYou can pay out your Concreit financial investment at any moment, with no minimum size of time requiredThe application uses an extra liquid option to buying mortgage notes directlyManaged by a team of specialists that meticulously select each investment for the portfolioThis means that financiers can be certain that their money remains in good hands Not a good fit for people looking for higher-risk investments, such as financings made to speculators that repair and turn homesWhile returns from first-lien home mortgages are a lot more foreseeable, they might be less than spending in real estate equity when the real estate market starts to recoverConcreit assists you to quickly spend in what works for you when it benefits you with auto-investments and monetary goals.

Shown up Homes is a platform for purchasing shares of rental homes and temporary vacation rentals. The company finds homes to spend in, takes care of locating lessees, and oversees the residential or commercial property monitoring and maintenance on your behalf.

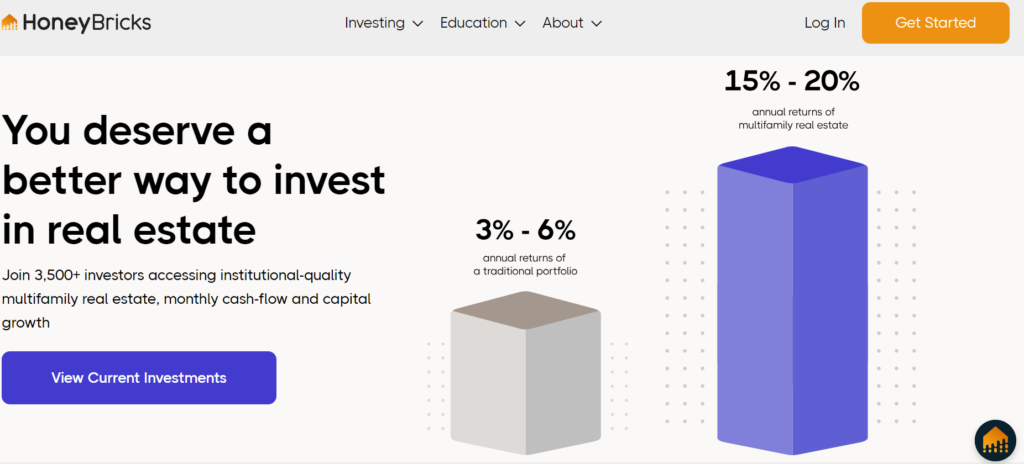

However, the low minimum investment makes DiversyFund worth taking into consideration if you want to begin in commercial realty investing without running the risk of a great deal of cash. Low investment minimum makes purchasing apartment attainableInvestment method specializes in multifamily properties that have in between 100-200 systems and create favorable cash money flowFunds are reinvested into value-add improvements to boost the residential or commercial property and market at an appreciated worth Automatic dividend reinvestment and a long holding period of regarding 5 yearsLack of a secondary market makes share highly illiquidDiversyFund costs a 2% system charge for possession administration plus a share of the profits if a property is marketed above a specified difficulty price Fundrise uses a selection of ways to buy business actual estate, consisting of brand-new home growths and multifamily building.

What is the best way to compare Commercial Property Investments For Accredited Investors options?

Landa plans on owning and handling their leasings over the lengthy term yet additionally offers a trading platform where you can purchase or sell shares when all of the first offering shares of a residential property are sold. Low minimal financial investment and no charges to investInvest in residential rental building equityAvailable circulations are paid monthly Landa bills a procurement charge of as much as 6% and a home administration fee of as much as 8%, which reduces any kind of circulation amountEquity investments in property rental building might lead to a loss if home prices declineShares are illiquid if an initial offering is not totally offered or there are no customers for shares noted on the Landa app system RealtyMogul has 2 non-publicly traded REITs for non-accredited investors: the Earnings REIT and Development REIT.

This suggests that RealtyMogul may not be the very best choice for those financiers searching for supposition. If you wish to invest in a private placement offering by an actual estate company on the platform, you should be an accredited memberHigh minimum financial investment compared to other different platforms Roofstock may be the ideal option for investing straight in single-family rental buildings, smaller multifamily buildings of 2-4 units, and short-term holiday leasings.

Financiers can review residential or commercial properties, bargain a bargain, make an offer, and shut the deal online. Thousands of residential rental properties to pick from in dozens of various marketsProperties are pre-inspected and vetted, with low deal costs for purchasers and sellersRoofstock offers a lease-up warranty and a 30-day money-back guarantee Need to purchase home straight-out or get financingDirectly owning actual estate is a very illiquid investmentInvestors have to have enough funds for prospective fixings and to pay for expenditures when the home is vacant Streitwise deals financiers the opportunity to purchase its exclusive equity REIT, an expertly handled business realty property profile.

Who has the best support for Real Estate Development Opportunities For Accredited Investors investors?

This results in a profile that has beaten those of other robo-advisors, and you'll pay less than you would certainly for a common bush fund. On the other hand, costs are more than most robo-advisors. The system may be an excellent suit for investors comfy with even more danger for more possible returns.

The Development & Earnings REIT and the Yieldstreet Prism Fund are offered to all capitalists, no matter of accreditation condition. The REIT gives access to a diversified pool of real estate investments. The Yieldstreet Prism Fund allows you to buy numerous Yieldstreet alternative asset courses with a single financial investment allotment.

Passive Real Estate Income For Accredited Investors

This info is not a recommendation to acquire, hold, or sell a financial investment or economic product, or take any kind of activity. This info is neither individualized nor a research report, and have to not act as the basis for any type of investment choice. All investments involve threat, consisting of the possible loss of capital.

Neither Concreit nor any of its affiliates offers tax obligation recommendations or investment referrals and do not stand for in any fashion that the outcomes defined herein or on the Site will certainly lead to any kind of particular investment or tax repercussion. Prior to making choices with legal, tax, or audit effects, you ought to seek advice from suitable experts.

Accredited Investor Property Portfolios

Since 2012, over 100+ genuine estate crowdfunding websites have actually come right into existence. How do you identify what the top genuine estate crowdfunding websites are?

I'm a totally subscribed participant to every one of the ones pointed out on my listing and I maintain a close eye on every one of these systems to invest in brand-new offers. I additionally have the opportunity to read about how offers from systems are doing from capitalists in our community, Easy Income Docs.

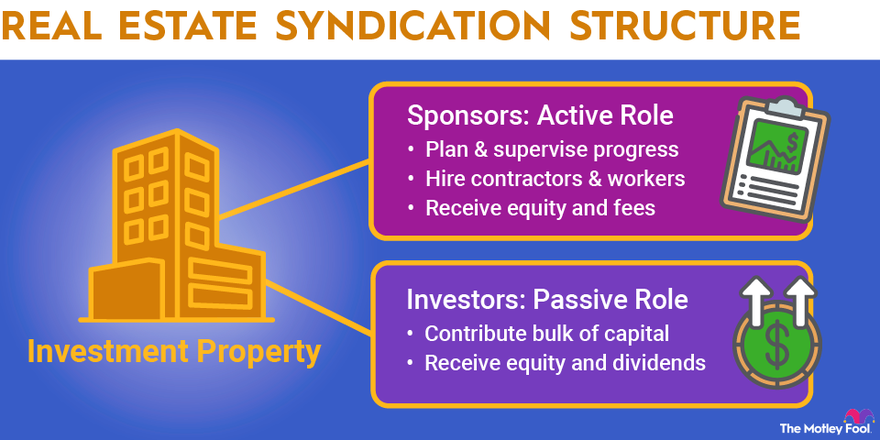

They might have a slightly reduced volume at this moment than a few of the various other websites, however they state it results from their incredibly rigid vetting process. I'm fine with that because inevitably all of it boils down to exactly how well the platforms vet the offers (Real Estate Syndication for Accredited Investors). To make it also a lot more unique, they directly co-invest in every offer, adding several of their very own skin in the video game

Table of Contents

Latest Posts

Tax Delinquent Land Near Me

Buying Homes For Back Taxes

Property Tax Delinquent

More

Latest Posts

Tax Delinquent Land Near Me

Buying Homes For Back Taxes

Property Tax Delinquent