All Categories

Featured

Play the waiting game till the building has been confiscated by the area and offered and the tax obligation sale.

Going after excess proceeds supplies some pros and cons as a business. Consider these prior to you include this approach to your actual estate spending collection.

There is the possibility that you will gain absolutely nothing in the end. You might shed not just your money (which ideally won't be extremely much), yet you'll likewise lose your time too (which, in my mind, deserves a lot a lot more). Waiting to collect on tax obligation sale excess calls for a great deal of sitting, waiting, and wishing for outcomes that normally have a 50/50 possibility (on standard) of panning out positively.

Gathering excess profits isn't something you can do in all 50 states. If you have actually currently obtained a residential property that you desire to "chance" on with this method, you 'd much better hope it's not in the wrong part of the nation. I'll be honestI haven't spent a whole lot of time messing around in this location of spending since I can not handle the mind-numbingly slow speed and the full absence of control over the process.

In enhancement, many states have laws influencing proposals that exceed the opening proposal. Payments over the county's criteria are known as tax sale excess and can be successful investments. The details on overages can develop problems if you aren't mindful of them.

In this article we inform you how to obtain lists of tax excess and make cash on these possessions. Tax obligation sale overages, likewise referred to as excess funds or premium quotes, are the amounts proposal over the beginning cost at a tax auction. The term describes the dollars the capitalist spends when bidding process over the opening quote.

The $40,000 boost over the original bid is the tax sale excess. Asserting tax sale overages indicates acquiring the excess cash paid during an auction.

That stated, tax obligation sale overage insurance claims have actually shared characteristics throughout a lot of states. tax sale overages business. Normally, the area holds the cash for a specified period depending upon the state. During this period, previous owners and home loan holders can get in touch with the area and obtain the excess. Regions normally do not track down previous proprietors for this function.

If the duration runs out prior to any kind of interested events assert the tax obligation sale excess, the area or state generally soaks up the funds. As soon as the cash mosts likely to the government, the opportunity of declaring it disappears. Therefore, previous proprietors get on a strict timeline to case excess on their properties. While excess usually don't equate to greater revenues, capitalists can take benefit of them in a number of methods.

Broward Tax Deed Surplus

Remember, your state laws influence tax sale excess, so your state may not allow investors to gather overage rate of interest, such as Colorado. In states like Texas and Georgia, you'll earn rate of interest on your entire quote. While this element doesn't suggest you can claim the excess, it does help mitigate your expenditures when you bid high.

Keep in mind, it could not be legal in your state, meaning you're restricted to gathering rate of interest on the excess. As mentioned over, a financier can locate means to benefit from tax obligation sale excess. Since interest earnings can apply to your whole bid and previous owners can declare overages, you can leverage your knowledge and devices in these scenarios to take full advantage of returns.

As with any kind of investment, study is the essential opening action. Your due diligence will certainly supply the required insight right into the properties available at the next auction. Whether you use Tax obligation Sale Resources for financial investment data or call your area for details, an extensive analysis of each home lets you see which homes fit your investment version. An important aspect to keep in mind with tax sale overages is that in a lot of states, you only need to pay the region 20% of your complete bid up front., have regulations that go beyond this policy, so once more, study your state legislations.

Rather, you only require 20% of the bid. Nonetheless, if the residential or commercial property doesn't redeem at the end of the redemption duration, you'll need the staying 80% to acquire the tax action. Since you pay 20% of your proposal, you can make rate of interest on an overage without paying the full rate.

Once again, if it's lawful in your state and county, you can work with them to help them recoup overage funds for an additional cost. You can collect passion on an overage bid and charge a fee to improve the overage insurance claim procedure for the previous proprietor.

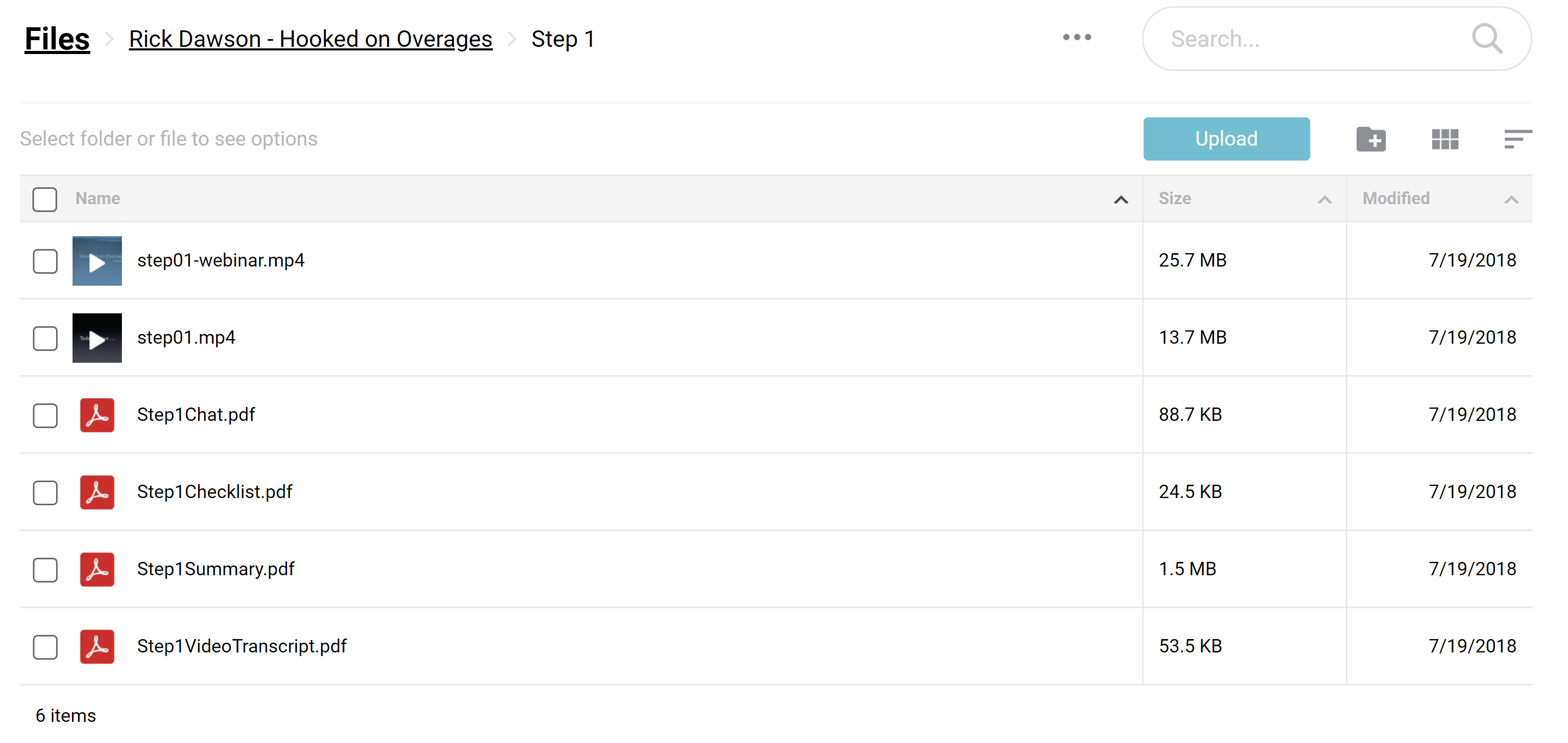

Overage enthusiasts can filter by state, region, residential property type, minimal overage quantity, and optimum overage quantity. As soon as the information has been filteringed system the collectors can determine if they intend to add the miss mapped data bundle to their leads, and after that spend for just the validated leads that were found.

House Tax Sale Auction

To get going with this video game changing item, you can discover more right here. The finest way to obtain tax obligation sale excess leads Concentrating on tax obligation sale overages rather of conventional tax obligation lien and tax act spending requires a specific method. Additionally, much like any type of other investment method, it provides unique benefits and drawbacks.

Otherwise, you'll be susceptible to unseen threats and lawful implications. Tax obligation sale excess can form the basis of your investment design because they offer a low-cost method to generate income. You don't have to bid on properties at public auction to invest in tax sale overages. Rather, you can look into existing overages and the past owners who have a right to the cash.

Doing so does not cost hundreds of thousands of bucks like purchasing multiple tax liens would certainly. Rather, your research, which might include miss tracing, would set you back a somewhat little charge. Any kind of state with an overbid or superior quote technique for public auctions will have tax sale overage chances for capitalists. Bear in mind, some state laws prevent overage choices for previous proprietors, and this concern is in fact the subject of a present High court instance.

Your sources and methodology will certainly determine the best setting for tax overage investing. That stated, one technique to take is gathering interest on high premiums.

Any type of auction or foreclosure including excess funds is a financial investment opportunity. You can invest hours looking into the previous proprietor of a residential property with excess funds and call them just to uncover that they aren't interested in pursuing the cash.

Latest Posts

Tax Delinquent Land Near Me

Buying Homes For Back Taxes

Property Tax Delinquent